Our money is rarely a topic of conversation at the courthouse. We are often stoked to talk about the law . . . always primed to share details of our latest victory or penetrating cross- examination. But what about money? When our law practice closes its doors for the last time, what will we have to show for our decades of sacrifice? Hopefully, we’ll have some degree of financial freedom. But the statistics are dismal. Americans do not save enough. In 2015, the United States Government Accountability Office reported about one-half of households age 55 and older had no retirement savings.1 And of those who did have savings, about 48% believed their nest egg would not be enough to maintain their living standards in retirement.2 It’s a struggle to save money. We can only cut the pie into so many pieces. Further, most criminal defense lawyers I know practice alone and don’t have access to a 401(k) plan, employer matching funds, or automatic payroll deductions. Compounding the problem is a lack of financial literacy.3 Nonetheless, defense lawyers need a plan – a system of regular saving. To better understand how to put their money to work, they may also need insight into the mysteries of investing.

examination. But what about money? When our law practice closes its doors for the last time, what will we have to show for our decades of sacrifice? Hopefully, we’ll have some degree of financial freedom. But the statistics are dismal. Americans do not save enough. In 2015, the United States Government Accountability Office reported about one-half of households age 55 and older had no retirement savings.1 And of those who did have savings, about 48% believed their nest egg would not be enough to maintain their living standards in retirement.2 It’s a struggle to save money. We can only cut the pie into so many pieces. Further, most criminal defense lawyers I know practice alone and don’t have access to a 401(k) plan, employer matching funds, or automatic payroll deductions. Compounding the problem is a lack of financial literacy.3 Nonetheless, defense lawyers need a plan – a system of regular saving. To better understand how to put their money to work, they may also need insight into the mysteries of investing.

Disclaimer: I am a self-taught investor. I am not a certified financial planner. Notwithstanding, I’ve personally managed my family’s assets for over 20 years using a system of saving, asset allocation, and portfolio rebalancing. My family’s assets have grown. I understand I can lose money, but I’ve not lost my shirt. I am not a day trader. I do not attempt to time financial markets. I do not speculate on “hot stocks.” Put another way, I don’t chase performance. I invest whether markets are going up or going down. I avoid “getting out” of the markets when they perform poorly. I have a plan. I’ve stuck with it regardless of media reports, the Dow Jones, and regardless of bear or bull markets. I recognize I cannot predict the future. I accept the inevitable ups and downs. Nonetheless, I’ve patiently invested according to a specific long-term formula. Granted, my way is not the only way; it’s only one way to access the financial markets. If you can’t (or won’t) do it yourself, then hire a trusted financial advisor to lead you.

If you personally manage your assets you’ll need an account with a brokerage firm like Charles Schwab, Ameritrade, Vanguard, Scottrade, and the like. A brokerage firm is a financial institution that facilitates the buying and selling of financial securities. Consult with your accountant or financial advisor to determine the type(s) of account(s) you need. One type is the Simplified Employee Pension (SEP). A SEP is a retirement plan established by employers, including self-employed individuals. The SEP is a plan to which employers may make tax-deductible contributions on behalf of eligible employees, including the business owner. An Individual Retirement Account (IRA) is an account set up for an individual. It allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. There are three main types of IRAs – Traditional, Roth, and Rollover. Again, consult with your accountant or financial advisor to determine the best account(s) for your needs. You can often download the necessary forms to open these accounts from the brokerage firm websites.

There is no question more fundamental to personal finance than how much you should save. But how much you should save varies considerably based on circumstances. For example, a 20 year old with several decades until retirement can save a lower percentage of their income than, say, a baby boomer just starting to stockpile for retirement. A rule of thumb is saving approximately 15% of yearly salary. This is a rough approximation, of course. If you’ve waited until you’re 50 to begin you’ll need much more than 15%. If you’re in your mid-twenties you might get by with something less. Your accountant can help you determine your account contribution limits each year. We can never begin saving too soon as the key to financial growth is time and compounding interest.

Once you’ve funded your SEP or IRA you are now ready to begin investing. The first decision will be how to allocate your investments into different types of assets classes and categories. Asset allocation has far more impact on your results than any single investment decision you may make.4 It attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor’s risk tolerance, goals, and investment time frame. An asset class is a group of securities that exhibit similar characteristics, behave similarly in the marketplace, and are subject to the same regulations. The three principle asset classes are equities (stocks), fixed-income (bonds), and cash equivalents (money market instruments). Whatever the asset class, each one is expected to reflect different risk and return characteristics. Each one may (and probably will) perform differently in any given market environment. Asset categories are subsets of their asset class. For example, within the stock asset class there are domestic and foreign stocks. Within those categories are small-capitization and large-capitalization stocks. Stocks can also be classified as growth or value stocks. Another example is within the bond asset class. There are government bonds, municipal bonds, and corporate bonds to choose from.

Once you’ve funded your SEP or IRA you are now ready to begin investing. The first decision will be how to allocate your investments into different types of assets classes and categories. Asset allocation has far more impact on your results than any single investment decision you may make.4 It attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investor’s risk tolerance, goals, and investment time frame. An asset class is a group of securities that exhibit similar characteristics, behave similarly in the marketplace, and are subject to the same regulations. The three principle asset classes are equities (stocks), fixed-income (bonds), and cash equivalents (money market instruments). Whatever the asset class, each one is expected to reflect different risk and return characteristics. Each one may (and probably will) perform differently in any given market environment. Asset categories are subsets of their asset class. For example, within the stock asset class there are domestic and foreign stocks. Within those categories are small-capitization and large-capitalization stocks. Stocks can also be classified as growth or value stocks. Another example is within the bond asset class. There are government bonds, municipal bonds, and corporate bonds to choose from.

Allocating your investments into different classes and categories utilizes a concept called diversification. Diversification is a risk management technique that mixes a wide variety of investments (asset classes and categories) within a portfolio. The rationale behind diversification is that a portfolio of different kinds of investments will, on average, yield higher returns and expose the investor to a lower risk than any individual investment. In other words, the positive performance of some investments will balance the negative performance of others in the same portfolio. Diversification means not investing everything you have into one area. For instance, if you invest all your money into one stock, or into only technology stocks, or into only real estate; you are not diversified. Diversification helps you spread the risk without all your eggs in one basket. And there are products available through your brokerage firm that give you instant diversification. These are called index mutual funds and exchange-traded funds (ETFs). An index fund is a type of mutual fund with a portfolio constructed to match or track the component companies of a market index, like the Standard & Poor’s 500 Index (S&P 500). The S&P 500 index is often used for mutual funds that identify themselves as domestic “large-cap” funds. Another index is the Russell 2000. It’s a small-capitalization stock market index and, by far, the most common index for mutual funds that identify themselves as domestic “small-cap” funds. An index mutual fund is said to provide broad market exposure (diversification), low operating expenses, and low portfolio turnover. Other commonly known domestic indexes are the Nasdaq Composite Index, the Wilshire 5000, and the Dow Jones Industrial Average. Exchange-traded funds (ETFs) also track stock and bond indexes and can provide the investor with a large degree of diversification.

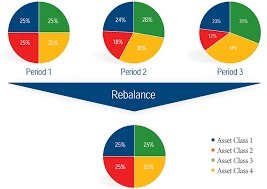

Besides regular contributions to your SEP or IRA, yearly rebalancing of your portfolio is necessary. Rebalancing is the process of realigning the weightings of your portfolio assets. Rebalancing involves periodically buying or selling assets in your portfolio to maintain your original desired asset allocation. For example, say your original target asset allocation was 50% stocks and 50% bonds. If your stocks performed well during the period it could have increased the stock weighting of your portfolio to 70%. You may then decide to sell some of your stocks (sell high) to buy more bonds (buy low) to get back to your original target allocation of 50/50. Once you decide how to allocate your money and periodically rebalance, time and compounding interest does the rest.

Rebalancing involves periodically buying or selling assets in your portfolio to maintain your original desired asset allocation. For example, say your original target asset allocation was 50% stocks and 50% bonds. If your stocks performed well during the period it could have increased the stock weighting of your portfolio to 70%. You may then decide to sell some of your stocks (sell high) to buy more bonds (buy low) to get back to your original target allocation of 50/50. Once you decide how to allocate your money and periodically rebalance, time and compounding interest does the rest.

Investing money is not mysterious once we understand some basics. When it’s time to close our law practice doors for the last time, we hope to have something to show for the years of hard work. Imagining life in 20-30 years may motivate us to save more and invest for growth. In any event, we criminal defense lawyers need a disciplined plan to prepare for retirement; a plan for saving and investing. Utilizing the financial markets is one way to accomplish that goal. With some committed self-study anyone can learn how to wisely invest and plan for life after the law.

1.”Retirement Security: Most Households Approaching Retirement Have Low Savings.” U.S. GAO -. 12 May 2015. Web. 26 Mar. 2016., p. 7 <http://www.gao.gov/products/GAO-15-419>

2. Id., p. 34.

3. Republic, Russ Wiles The Arizona. “As Life Spans Rise, Healthy Retirees Need Even Healthier Savings.” USA Today. Gannett, 2016. Web. 27 Mar. 2016. <http://www.usatoday.com/story/money/personalfinance/2016/03/26/retirement-savings-investing-life-spans-retirees/81863296/>.

4. Merriman, Paul, and Rich Buck. “The Ultimate Buy and Hold Strategy 2014 – Paul Merriman.” Paul Merman, Sound Investing For Every Stage of Life. Web. 27 Mar. 2016. <http://paulmerriman.com/the-ultimate-buy-hold-strategy-2014/>.

(“Off the Back” featured in the “Voice For The Defense” April 2016)

Stephen Gustitis is a criminal defense lawyer in Bryan-College Station. He is Board Certified in Criminal Law by the Texas Board of Legal Specialization. He is also a husband, father, and retired amateur bicycle racer.

“Off the Back” is an expression in competitive road cycling describing a rider dropped by the lead group who has lost the energy saving benefit of riding in the group’s slipstream. Once off the back the rider struggles alone in the wind to catch up. The life of a criminal defense lawyer shares many of the characteristics of a bicycle rider struggling alone, in the wind, and “Off the Back.” This column is for them.